Selectively optimistic. The hitter’s count.

Maxam Diversified Strategies – Q2 2023 Commentary

Dear fellow investors,

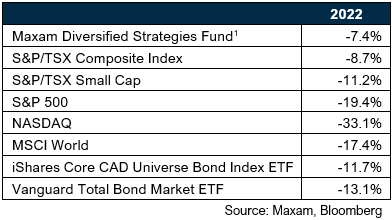

The Maxam Diversified Strategies Fund1 gained +1.4% in the month of June and finished the second quarter -2.6%.

Major market narratives so far in 2023 have included continued interest rate increases, a U.S. regional banking crisis, recession fears, the emergence of artificial intelligence as a FOMO2 inducing investment theme, and the narrow breadth of U.S. equity market strength.

After 10 consecutive interest rate hikes, the Federal Reserve left rates unchanged in June. While U.S. central bankers continue to project higher interest rates, they now appear more willing to wait to assess the impact of their hiking campaign on inflation and the economy. Canada’s central bank took a similar pause in January before raising again, citing tight labour markets and persistent inflationary pressures in services.

Promisingly, inflation has declined from high single-digit to mid-single digit levels over the last year or so – although it remains above target. And bellwether equity indices, most notably in the U.S., have continued to improve, perhaps sniffing out an end to this rate hiking cycle, with help from some AI hype and excitement.

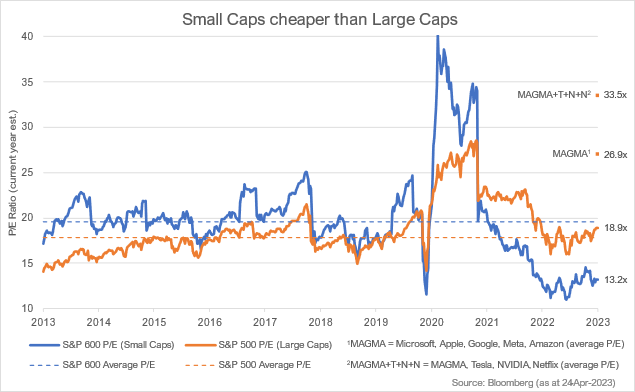

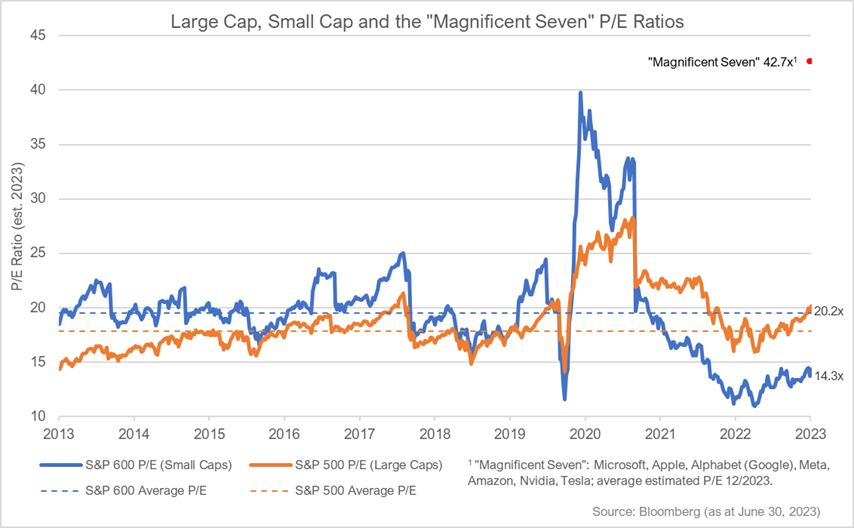

However, the breadth of equity market leadership has been very narrow this year with the significant dominance of the magnificent seven – Apple, Microsoft, Google, Amazon, Meta, NVIDIA and Tesla. Case in point, the equal weighted S&P 500 was negative through the first five months of the year while the market cap weighted S&P 500 was up close to double digits. At the end of the second quarter the combined weight of these seven companies comprised almost 46% percent of the NASDAQ Composite Index3 and they traded at an average P/E ratio of 43x4.

While narrow leadership from just the very largest companies can sometimes mask issues, it can, alternatively, also hide compelling opportunities. Encouragingly, market breadth has begun to improve over the last few weeks with positive price action starting to extend beneath the surface of the mega caps. We view this as a welcome development…and perhaps an inflection point for some unloved and/or ignored companies.

Climbing the wall.

In recent commentaries we have highlighted that investors have been ignoring certain segments of the market. The apathy towards small and mid-cap companies, and to some sectors, is as significant as we have seen in several years, and this has led to some valuations that may already reflect a recessionary environment.

This dynamic is part of the compelling opportunity today:

- Attractive valuations and growth prospects beneath the surface of the mega-caps.

- Canadian equities are broadly more attractively valued than U.S. equities.

- Select companies more than pricing in a recession in our opinion.

- Small/mid-caps are much cheaper than large caps5.

- Small caps typically outperform during periods of declining inflation and exiting recessions.

- Select special situations offer compelling reward relative to risk.

We continue to see the environment shifting towards attractive value and fundamentals, and away from speculation and growth at any price.

Exposures.

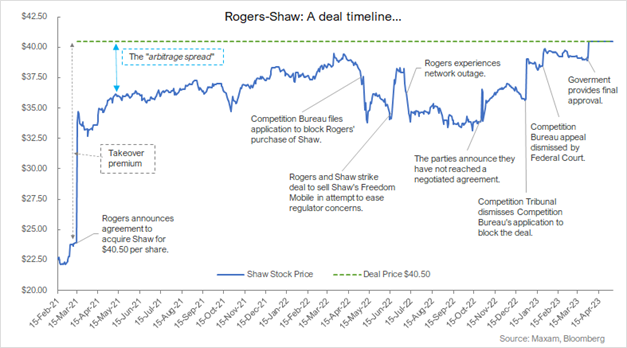

At the end of the first quarter the fund was diversified across 11 industry sectors and its top 25 positions accounted for approximately 51% of net exposure. From a strategy perspective, fund exposures include 64% in fundamental longs, 21% in special situations, 4% in convertible debentures, 13% in arbitrage, and approximately 2% of gross exposure in short positions.

Positive contributors to fund performance during the first half of 2023 included H2O Innovation, The Westaim Corp, Sylogist, DRI Healthcare, Maxim Power, and Ag Growth International.

Our investments in H2O Innovation and Maxim Power are good examples of investing in unloved or ignored companies when there is a compelling reward to risk opportunity.

In our Q2 2022 commentary we stated that we had recently added to our position in H2O Innovation, a water infrastructure and technology company with highly recurring revenues and a growing backlog of business, at around $2 per share. In our view we were purchasing shares of a high-quality business that was trading at an unreasonably depressed share price. H2O’s price stayed depressed through the remainder of 2022 before it began to capture the attention of investors again. It closed at $3.20 per share on June 30.

Maxim Power, an independent power producer based in Alberta, was late in the process of commissioning an upgrade to its core electricity generating asset in Grand Cache, AB when it announced that a fire incident had occurred in late September 2022, potentially delaying operations. While we did not own shares in Maxim at the time, we were familiar with the company from a previous investment and able to act quickly on the opportunity. From mid-October 2022 to year end, we purchased shares of Maxim at prices largely between $3.40 to $3.60 per share with the view that proceeds from insurance coverage would see them through repairs and remaining commissioning. Maxim’s shares closed the second quarter of 2023 at $4.76 per share.

We believe we have more value and catalyst rich names like these in the fund today.

Hitter’s count.

The summer months are notoriously slow for the markets, and we don’t suggest it will be all smooth sailing ahead – after all, it is rarely a smooth ride for equities. We would describe our current outlook and actions as selectively optimistic.

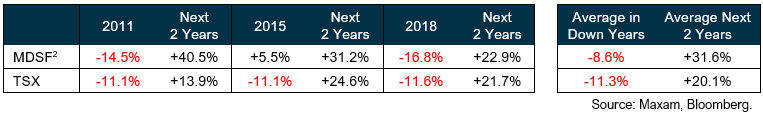

Buying fear, and conversely selling exuberance, is hard to do, but history has repeatedly shown us that it is the best long-term approach. In a market environment where plenty of negative information has been priced into securities over the last 18 months, we see opportunity to deploy capital selectively, in specific companies trading at valuations where we believe the odds are stacked in our favour – the hitter’s count.

We are excited about the prospects for the remainder of 2023 and beyond – as much as we have been in several years.

Thank you for your trust and confidence. Please don’t hesitate to reach out with any questions.

Sincerely,

Travis Dowle, CFA

President & Fund Manager

Maxam Capital Management Ltd.

1 Maxam Diversified Strategies Fund, Series F, net of fees and expenses. Please contact us regarding other classes of fund units or visit our website www.maxamcm.com

2 Do we really still have to explain this one?! FOMO = Fear of Missing Out.

3 https://indexes.nasdaqomx.com/docs/FS_COMP.pdf

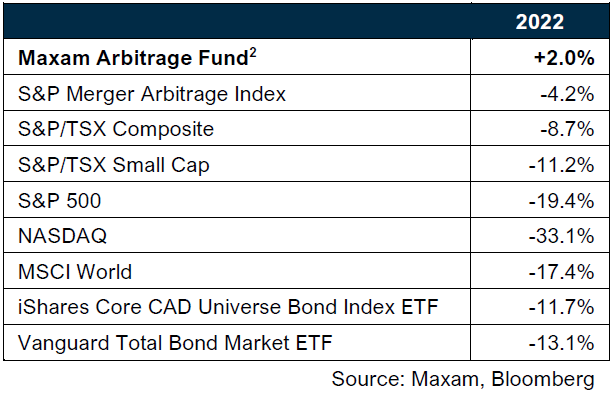

4 The “Magnificent Seven” traded at an average price to earnings multiple of 43x as at June 30, 2023 (source Bloomberg, 12/2023 analyst estimates). As a bonus, see chart below showing some relative valuations.

5 Here’s a chart showing P/E ratios for U.S. large caps and small caps over the last 10 years, plus the P/E ratio for the Magnificent Seven on June 30, 2023. As you can see, small caps have historically traded at a premium valuation to large caps, but today they are at a material discount.

This information is intended to provide you with information about the Maxam Diversified Strategies Fund and is not an offer to sell or solicit. Disclosed performance is based on Class X, A and F units and is net of all fees and expenses. Inception date for Class X is June 30, 2009; Class A is December 31, 2012 and; Class F is January 31, 2013. The performance fees on Class X units are subject to a 5% annualized hurdle. Important information about the Fund is contained in the Simplified Prospectus and Fund Facts which should be read carefully before investing. Prior to August 24, 2022 this Fund was offered via Offering Memorandum only and was not a reporting issuer. Historical audited financial statements for this period are archived here. The expenses of the Fund would have been higher during such period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Prior to becoming a reporting issuer, the Fund was not subject to the investment restrictions and practices in NI 81-102. Important information about the Fund is contained in the Fund’s Simplified Prospectus, which should be read before investing. This presentation is neither an offer to sell securities nor a solicitation to sell securities. The securities of the Fund are sold only through IIROC registered dealers in those jurisdictions where it may be lawfully offered for sale. Accredited investors or certain other qualified investors may also purchase securities through Maxam Capital Management Ltd in reliance on certain prospectus exemptions available in National Instrument 45-106. Investors should consult with their own investment advisor and obtain a copy of our applicable Simplified Prospectus and Fund Facts documents before investing in the Fund. Investors should seek advice on the risks of investing in the Fund before investing. This document may contain forward-looking statements. These forward-looking statements are based upon the reasonable beliefs of Maxam Capital Management Ltd. at the time they are made and are not guarantees of future performance, are subject to numerous assumptions, and involve risks and uncertainties about general economic factors which may change over time. Maxam assumes no duty, and does not undertake, to update any forward-looking statement and cautions you not to place undue reliance on these statements as actual events or results may differ materially from those expressed or implied in any forward-looking statements made. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Simplified Prospectus before investing. Any indicated rates of return are the historical annual total returns including changes in value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This document is not intended to provide legal, accounting, tax or investment advice. Please consult an investment advisor and read the prospectus for the Maxam Diversified Strategies Fund prior to investing.