Challenging markets always unveil significant opportunities.

Maxam Diversified Strategies Fund – Q3 2022 Commentary

Dear fellow investors,

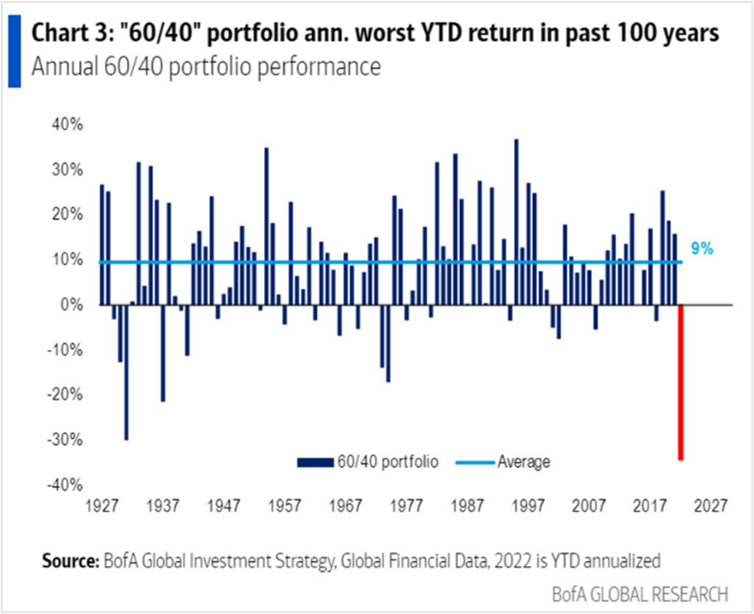

The current investment environment continues to be dominated by high inflation, rising interest rates, ongoing supply chain issues, fears of a recession, an energy crisis in Europe and geopolitical tensions. As a result, both equity and bond markets have declined in unison through the first three quarters of 2022 – a rare occurrence that has wreaked havoc on the traditional “60/40” balanced portfolio.

Equities and bonds did stage a summer rally through mid-August before turning south for the final six weeks of the third quarter. Central banks, notably the U.S. Federal Reserve (the “Fed”), threw cold water on investors by reiterating that they will be steadfast in their efforts to break the back of inflation. With no “Fed put” or “Fed Pivot”1 currently in sight, market participants seem to be coming to terms with the Fed’s resolve.

A challenging and shifting market environment always delivers and unveils compelling opportunities. With security prices down significantly, it has most certainly become a more fertile investment environment.

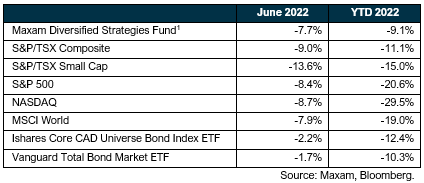

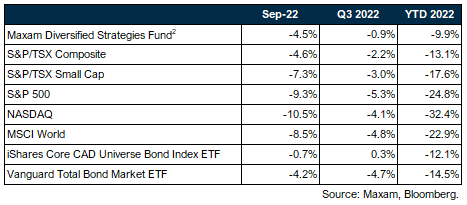

The Maxam Diversified Strategies Fund2 declined -0.91% in the third quarter of 2022. Here is the tale of the tape for September, Q3 and year-to-date:

Exposures.

We believe the fund’s exposures position us well to take advantage of the current environment.

Exposure is diversified across sectors, strategies, and individual securities. As at the end of the third quarter the fund was invested across all 11 sectors with no sector weight larger than 14% of net exposure (excluding arbitrage), and the fund’s top 10 holdings accounted for 27% of assets.

The fund’s net allocation to arbitrage was 28%. In addition to providing a stable return profile that exhibits low correlation with the general market, the fund’s arbitrage allocation is highly liquid and can be used to opportunistically take advantage of value and special situations-oriented investments as they arise in a volatile market.

Shorts and hedging exposure was 13% as at the end of the quarter, consisting primarily of single-stock shorts in companies that we think are likely to decline due to company-specific reasons or market dynamics. We also have some market hedge exposure expressed via put and VIX call spreads that should help provide some protection against a general market decline.

The fund’s allocation to arbitrage, a market neutral strategy, has provided some protection relative to the decline in equity markets, as has the fund’s short exposure.

Notable positive contributors to the fund during the third quarter included water infrastructure and technology company H20 Innovation Inc, financial services company Westaim Corp, and high-quality fashion retailer Aritzia. Individual holdings detracting from results included HLS Therapeutics, Superior Plus and VitalHub.

Balance sheet analysis is often a starting point for us, and it is a particularly key consideration today during an environment characterized by higher rates and deteriorating credit availability. We also like to invest in businesses where leaders have real skin in the game and strong alignment with shareholders – even better if we see recent insider buying.

For example, we are currently buying shares in a financial services company that is trading at less than 6x next year’s earnings, is demonstrating accelerating revenue growth and has a well-covered dividend of approximately 4%. Oh, and insiders have been buying recently as well.

The significant decline in equity markets has undeniably created a more fertile investment landscape for us and, as value-oriented and flexible investors, we find our opportunity set has greatly expanded.

Looking ahead.

Sometimes it is worthwhile to look backwards to look forward.

We’ve experienced and invested through more than a few market declines and events over the years. From the bursting of the tech bubble in 2000, the financial crisis in 2008-09, the sovereign debt and Eurozone crisis in 2010-11, the growth scare and trade wars in 2018, the Covid crash in early 2020, and more.

Our experience and knowledge grew through those challenging markets and, I believe, we emerged as better investors. Investing requires constant learning and humility – without hubris.

We have also studied previous investment periods and regimes, the 1970’s (energy, conflicts) and the early 1980’s (inflation and rapid interest rate hikes) come to mind.

Each of the aforementioned market events and periods were different in their own right, but they all presented substantial and unique investment opportunities. And this time will be no different. As we have said in previous communications, “there are no bells and whistles at market tops or bottoms”. Today’s fears and concerns will eventually become yesterday’s opportunities.

This is an attractive environment for our investment style and strategy in our opinion – one that we believe increasingly favours our value-oriented and active approach.

We’re excited about deploying capital, selectively and patiently.

Thank you for your trust and confidence. Please don’t hesitate to reach out with any questions.

Sincerely,

Travis Dowle, CFA

President & Fund Manager

Maxam Capital Management Ltd.

1 From Investopedia.com: 1) The term “Fed put,” a play on the option term “put,” is the market belief that the Fed would step in and implement policies to limit the stock market’s decline beyond a certain threshold. 2) A Fed pivot occurs when the Federal Reserve, which is the U.S. central bank, reverses its policy outlook and changes course from expansionary (loose) to contractionary (tight) monetary policy—or, conversely, from contractionary to expansionary. A Fed pivot typically happens when economic conditions have fundamentally changed in such a way that the Fed can no longer continue its prior policy stance.

2 Maxam Diversified Strategies Fund, Series F, net of fees and expenses. Please contact us regarding other classes of fund units or visit our website www.maxamcm.com

Maxam Capital Management Ltd. is the manager for the Maxam Arbitrage Fund. Important information about the Fund is contained in the Fund’s Simplified Prospect us, which should be read before investing. This presentation is neither an offer to sell securities nor a solicitation to sell securities. Disclosed historical returns for periods greater than one year are annualized unless otherwise noted and are net of fees and expenses. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Simplified Prospectus before investing. Any indicated rates of return are the historical annual total returns including changes in value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. This document is not intended to provide legal, accounting, tax, or investment advice. Please consult an investment advisor and read the prospectus for the Maxam Arbitrage Fund prior to investing. Please contact us for more information at: (604) 685 0201 info@maxamcm.com www.maxamcm.com