Expecting the unexpected.

Maxam Diversified Strategies – Q2 2025 Commentary

Dear fellow investors,

The Maxam Diversified Strategies Fund1 (the “Fund”) gained +9.9% in the second quarter of 2025. Over the last five years the Fund has delivered an annualized return of +14.7%.

Wild ride.

The second quarter began on a gloomy note in early April when U.S. President Trump’s aggressive trade tariff announcements quickly injected significant uncertainty and volatility into financial markets, sending securities prices broadly lower. Then, approximately one week after pronouncing the “Liberation Day” tariffs, Trump declared a 90-day pause that marked the beginning of a turnaround for markets.

In addition to trade tensions, equity and bond markets were also challenged by escalating geopolitical conflicts and fiscal deficit concerns during the second quarter. However, improving trade negotiations, resilient economic data, and positive corporate earnings revisions not only calmed investor fears but enabled equities to rally and bond markets to stabilize.

Another recent narrative supporting investor confidence is the so-called ‘TACO’ trade. This is the notion that Trump cares more about market performance than he admits – therefore Trump Always Chickens Out when his rhetoric and policies are met with rising long bond yields and tumbling equity markets.

The current U.S. administration is now clearly focused on a growth-first agenda – perhaps throwing caution to the wind with the inflationary pressures that may ensue. Overall, this is a supportive environment for equities. However, we are mindful that while some of the aforementioned challenges have faded into the background, they have not vanished.

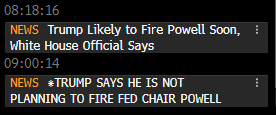

Investors should continue to expect volatility. At the very least we expect our newsfeed to remain eye-catching and sentiment shifting. Like this beauty from earlier this month2:

We will continue to look through the noise and endeavour to use market volatility to our advantage.

Positions and activity recap.

Market and security-specific volatility in the second quarter provided us with the opportunity to add to some of our higher conviction positions – especially early in the quarter. And as the quarter progressed, Fund performance benefited from strong breadth across the portfolio.

Notable positive contributors to performance included: Firan Technology Group, MDA Space, Information Services Group, Kraken Robotics, Itafos, Dexterra Group and Exchange Income Corp.

Firan Technology Group was the Fund’s top contributor to performance in the quarter. This manufacturer and provider of electronic products, technology, and subsystems to the aerospace and defense industries continues to benefit from strong multi-year demand across its key end markets.

Firan enjoys a unique competitive position with strong barriers to entry for its products and serves its customers from 11 manufacturing facilities across three different countries. In addition to strong end-market demand, Firan is establishing another facility in India to capitalize on regional demand and may seek to expand its product offering through strategic M&A. Despite recent strong share price performance, Firan continues to trade at an attractive and discounted multiple in our view – and it remains one of our largest positions.

Market volatility also afforded us the opportunity to initiate several new positions during the quarter at valuations we deem quite compelling. We continue to see opportunities with companies benefitting from increased defense spending, electricity infrastructure demand, and several idiosyncratic special situations – such as product launches, M&A catalysts, and spinoffs. We look forward to covering some of these companies in future commentaries.

It wasn’t all buying. During the quarter, we exited a few positions and trimmed others – either because our investment thesis had played out, valuations no longer offered attractive risk-reward, or new information prompted a change in our view.

We also added some tactical portfolio hedges that can help mitigate some downside that may arise during bouts of future market volatility.

You never know what you’re gonna get.3

While equity markets moved higher in the second quarter – climbing the proverbial wall of worry – we think it is prudent to continue to expect the unexpected in the current geopolitical climate.

As we have stated many times before, volatility and uncertainty can uncover and create compelling investment opportunities. Not only do we observe several trends that investors can benefit from, but there also continues to be a wide dispersion in valuations across the market cap spectrum that we can take advantage of.

In our view this is an environment that is rich with opportunity for active management – one that is well-suited to our flexible approach and value-oriented style. Please get in touch if you have any questions or if you would like to add to your investment in the Fund.

Sincerely,

Travis Dowle, CFA

President & Fund Manager

Maxam Capital Management Ltd.

1 Maxam Diversified Strategies Fund, Series F, net of fees and expenses. Please contact us regarding other classes of fund units or visit our website www.maxamcm.com.

2 A snip of back-to-back news headlines on our Bloomberg terminal on July 16, 2025.

3Yes, the famous line from the movie Forrest Gump. A little cringe perhaps… but it fits!

This information is intended to provide you with information about the Maxam Diversified Strategies Fund and is not an offer to sell or solicit. Disclosed performance is based on Class X, A and F units and is net of all fees and expenses. Inception date for Class X is June 30, 2009; Class A is December 31, 2012 and; Class F is January 31, 2013. The performance fees on Class X units are subject to a 5% annualized hurdle. Important information about the Fund is contained in the Simplified Prospectus and Fund Facts which should be read carefully before investing. Prior to August 24, 2022 this Fund was offered via Offering Memorandum only and was not a reporting issuer. Historical audited financial statements for this period are archived here. The expenses of the Fund would have been higher during such period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Prior to becoming a reporting issuer, the Fund was not subject to the investment restrictions and practices in NI 81-102. Important information about the Fund is contained in the Fund’s Simplified Prospectus, which should be read before investing. This presentation is neither an offer to sell securities nor a solicitation to sell securities. The securities of the Fund are sold only through IIROC registered dealers in those jurisdictions where it may be lawfully offered for sale. Accredited investors or certain other qualified investors may also purchase securities through Maxam Capital Management Ltd in reliance on certain prospectus exemptions available in National Instrument 45-106. Investors should consult with their own investment advisor and obtain a copy of our applicable Simplified Prospectus and Fund Facts documents before investing in the Fund. Investors should seek advice on the risks of investing in the Fund before investing. This document may contain forward-looking statements. These forward-looking statements are based upon the reasonable beliefs of Maxam Capital Management Ltd. at the time they are made and are not guarantees of future performance, are subject to numerous assumptions, and involve risks and uncertainties about general economic factors which may change over time. Maxam assumes no duty, and does not undertake, to update any forward-looking statement and cautions you not to place undue reliance on these statements as actual events or results may differ materially from those expressed or implied in any forward-looking statements made. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Simplified Prospectus before investing. Any indicated rates of return are the historical annual total returns including changes in value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This document is not intended to provide legal, accounting, tax or investment advice. Please consult an investment advisor and read the prospectus for the Maxam Diversified Strategies Fund prior to investing.