An inflection point for the markets as headwinds shift to tailwinds for small/mid caps and value. Let’s go!

Maxam Diversified Strategies – Q2 2024 Commentary

Dear fellow investors,

The Maxam Diversified Strategies Fund1 gained +0.4% in the second quarter of 2024 to finish the first six months of the year up +10.9%. Over the last 12 months the fund gained +17.5%.

Equity and bond market performance was mixed during the second quarter as investors analyzed shifting economic and inflation data, looking for signals as to the direction of interest rates. Market breadth (essentially the number of companies participating in a market move) was also mixed, showing signs of broadening out early in the quarter as inflation cooled, before narrowing in June – and now in July, breadth has distinctly broadened again.

The big and small picture.

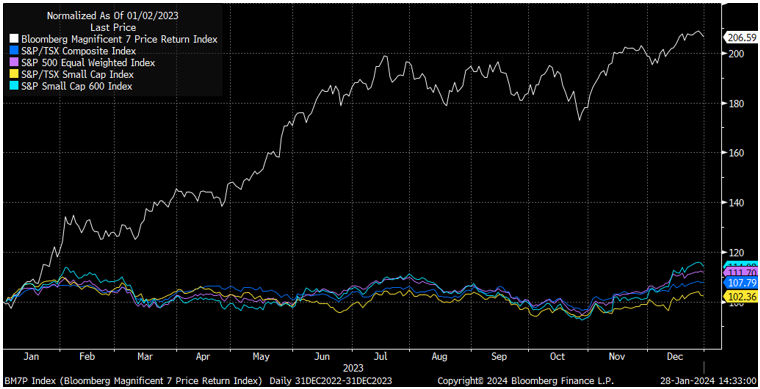

It is a well-known narrative by now – as central banks raised interest rates to tackle surging inflation, equity markets broadly declined before investors eventually sought the relative safety and growth of the mega caps, primarily technology companies which also ended up benefitting from excitement surrounding the artificial intelligence theme. Conversely, small and mid-cap companies – which are perceived as being more sensitive to the economy, inflation and interest rates – suffered disproportionately from investor outflows and disinterest.

This dynamic has resulted in a bifurcated market. At the narrow top end, significant growth and multiple expansion for many of the mega caps has left them valued with little margin for error. And in contrast, beneath the surface of the mega caps, there are many quality companies that trade at very attractive prices, offering compelling value to investors.

The Bank of Canada has already cut interest rates, and the U.S. Federal Reserve is signaling that they too will begin to normalize monetary policy – with markets forecasting a greater than 80% probability of an interest rate cut in September.

This is an important inflection point for the markets, because the above-mentioned headwinds – which led investors to shun small and mid-capitalization companies resulting in their significant underperformance – have now shifted to tailwinds that support their resurgence.

M&A leads the way.

A trend that we have been highlighting over the last few quarters is the pick-up in takeover activity. While we are not yet back to pre-Covid M&A levels, deal volumes have been solid and appear poised to improve with the shifting environment.

We have already begun to see an increase in small and mid-capitalization takeout activity as strategic and financial buyers opportunistically take advantage of attractive valuations. We covered this trend in more detail in our Maxam Arbitrage Fund Q2 commentary, including how we benefit from it in that unique and low-risk strategy.

Expected to drive even more deal activity is the increasing pressure that private equity firms are under to deploy their record US $1.2 trillion of capital – more than 26% of which was raised over four years ago2.

Some notable takeouts over the last several months north of the border include: Q4 Inc, Spark Power, Opsens, H2O Innovation, Neighbourly Pharmacy, MediaValet, Indigo Books & Music, mdf commerce, Park Lawn, Nuvei, Copperleaf Technologies, UGE International, Canadian Western Bank, Heroux Devtek, Stelco, and Hamilton Thorne.

Not all of these companies are your typical household names, but hopefully you’ll recognize a few as some of our holdings. And the fact that these names are not well-known is instructive as to the value and opportunity that is available in the lesser-known segments of the market.

While a takeout is not typically the sole focus of our investment thesis for a company, we are generally pleased to see other sophisticated investors pay a material premium for a company that we are invested in – as long as the consideration paid is fair and full, and our shares are not taken away from us too early.

We expect there will be a lot more M&A activity on the horizon.

Activity, positions, and exposures.

As mentioned earlier, the second quarter was mixed from a performance perspective. The fund was up in both April and May before giving back some of those gains in June to finish the quarter up +0.4%1.

A dynamic at play in Canada during June was the federal Liberal government’s increase in the capital gains inclusion rate that became effective on June 25th, 2024. The impending tax change led many of the year-to-date leaders, including some of our holdings, to experience some selling pressure as investors took action to crystallize capital gains ahead of the new rule coming into effect. This tax-driven selling was non-fundamentals based, and temporary in nature, presenting us with an opportunity to add to some of our favourite companies.

Some noteworthy companies that influenced the fund’s second quarter performance included:

Heroux Devtek, an aerospace manufacturer that specializes in landing gear for civil and military aircraft, appreciated after reporting record results that were ahead of expectations.

Westaim, a financial services investment company, gained after announcing that it sold a significant stake in its insurance subsidiary as well as reporting strong quarterly results.

Shares in transit bus manufacturer NFI Group increased in value after reporting strong new bookings and on market expectations that the stock would become a constituent in Canada’s S&P/TSX Composite index – which it ultimately did join in June.

Sylogist, a provider of mission-critical software to the public sector, moved higher following investor update meetings and on news that its larger peer, Blackbaud, had received takeover interest.

Detracting from performance in the second quarter was Ag Growth International. Shares in the equipment and solutions provider to the agriculture industry declined after the company reported quarterly results that missed expectations. Then, towards the end of May, shares rebounded on news that the company had received an unsolicited proposal to purchase the company – which they rejected as insufficient.

At the end of the second quarter the fund was well diversified across all 11 sectors with the top 25 positions accounting for 57% of net assets. From a strategy perspective, fund exposures include 73% in fundamental longs, 21% in special situations, 4% in convertible debentures, 4% in arbitrage, and 2% gross exposure in short positions.

A quick ‘subsequent to quarter end’ note: As you may have noticed in our comments above on M&A activity, Hamilton Thorne and Heroux Devtek, two of our core positions, announced in July that they have agreed to be acquired by private equity funds. Who’s next? We don’t know, but we have no doubt that many of our current holdings would be attractive acquisition targets.

The ingredients.

With declining inflation, interest rate cuts commencing, and certain segments of the market perhaps no longer representing good value – the elements are in place to draw investor attention towards the many quality companies that have lagged, are growing, and trade at attractive prices.

We are mindful that it is prudent to expect some volatility in a shifting market environment. There is always a wall-of-worry to climb – today investors face questions regarding economic growth, ongoing geopolitical conflicts, and a fiercely contested U.S. presidential election.

If there is a market pullback (and there usually is), we will be selectively taking advantage of it with our company-specific and value-oriented approach – an approach that we believe is particularly well-suited to this shifting environment.

Thank you for your trust and confidence. Please reach out with any questions.

Sincerely,

Travis Dowle, CFA

President & Fund Manager

Maxam Capital Management Ltd.

1 Maxam Diversified Strategies Fund, Series F, net of fees and expenses. Please contact us regarding other classes of fund units or visit our website www.maxamcm.com.

2 https://commercial.bmo.com/en/us/resource/mergers-acquisitions/specialty-finance/middle-market-ma-update-q2-2024/

This information is intended to provide you with information about the Maxam Diversified Strategies Fund and is not an offer to sell or solicit. Disclosed performance is based on Class X, A and F units and is net of all fees and expenses. Inception date for Class X is June 30, 2009; Class A is December 31, 2012 and; Class F is January 31, 2013. The performance fees on Class X units are subject to a 5% annualized hurdle. Important information about the Fund is contained in the Simplified Prospectus and Fund Facts which should be read carefully before investing. Prior to August 24, 2022 this Fund was offered via Offering Memorandum only and was not a reporting issuer. Historical audited financial statements for this period are archived here. The expenses of the Fund would have been higher during such period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Prior to becoming a reporting issuer, the Fund was not subject to the investment restrictions and practices in NI 81-102. Important information about the Fund is contained in the Fund’s Simplified Prospectus, which should be read before investing. This presentation is neither an offer to sell securities nor a solicitation to sell securities. The securities of the Fund are sold only through IIROC registered dealers in those jurisdictions where it may be lawfully offered for sale. Accredited investors or certain other qualified investors may also purchase securities through Maxam Capital Management Ltd in reliance on certain prospectus exemptions available in National Instrument 45-106. Investors should consult with their own investment advisor and obtain a copy of our applicable Simplified Prospectus and Fund Facts documents before investing in the Fund. Investors should seek advice on the risks of investing in the Fund before investing. This document may contain forward-looking statements. These forward-looking statements are based upon the reasonable beliefs of Maxam Capital Management Ltd. at the time they are made and are not guarantees of future performance, are subject to numerous assumptions, and involve risks and uncertainties about general economic factors which may change over time. Maxam assumes no duty, and does not undertake, to update any forward-looking statement and cautions you not to place undue reliance on these statements as actual events or results may differ materially from those expressed or implied in any forward-looking statements made. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the Simplified Prospectus before investing. Any indicated rates of return are the historical annual total returns including changes in value and reinvestment of all distributions and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. This document is not intended to provide legal, accounting, tax or investment advice. Please consult an investment advisor and read the prospectus for the Maxam Diversified Strategies Fund prior to investing.